Limited liability is a valuable risk management tool for entrepreneurs, but it is not a cure all.

Read MoreThe title of this post may sound like a straight-to-streaming rom-com about two strangers who wake up after a night out in Vegas only to remember they got married in a drive-thru ceremony the night before. Yet, somehow, it’s worse than that.

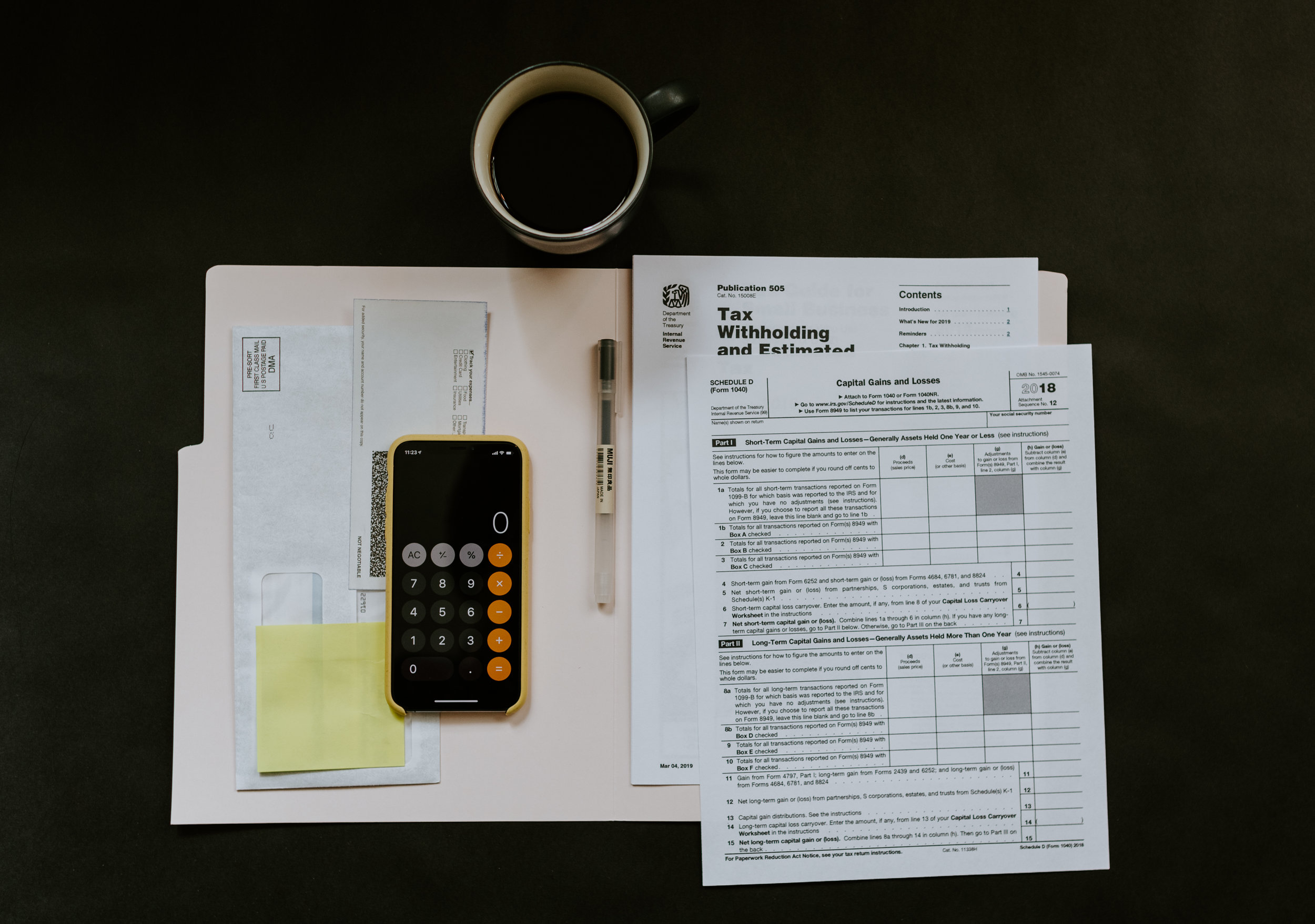

Read MoreEntrepreneurs may be able to use business losses to offset other income, provided the business is structured properly from a tax perspective.

Read MoreIn the latest installment of “what do words even mean” we bring you a mercifully short entry on the difference between LLC allocations and distributions.

Read MorePhantom income is income that a business owner has to pay taxes on despite not having received any cash to pay the tax from the business. It’s not great. But it’s avoidable.

Read MoreLocation is everything…or maybe not.

Read MoreIf you’re looking for a tax-related conversation piece for your next cocktail hour, look no further than this entry on the benefits of electing S corporation tax treatment.

Read MoreFind out how to avoid a common scam targeting newly formed Washington businesses.

Read MoreStarting your LLC required you to observe certain formalities; ending it will too. Make sure you’re aware of your responsibilities in dissolving the LLC and winding up its affairs.

Read MoreLegislative changes are on the way for how Washington corporate shareholders may acquire preemptive rights and cumulative voting.

Read MoreThe PLLC is a great choice for professional service providers (e.g., psychologists, dentists, lawyers, etc.) looking to start their own business in Washington.

Read MoreIf you woke up this morning brimming with curiosity about corporate shareholder meetings in Washington, you’re in for a real treat with this post.

Read More